Capstone Healthcare

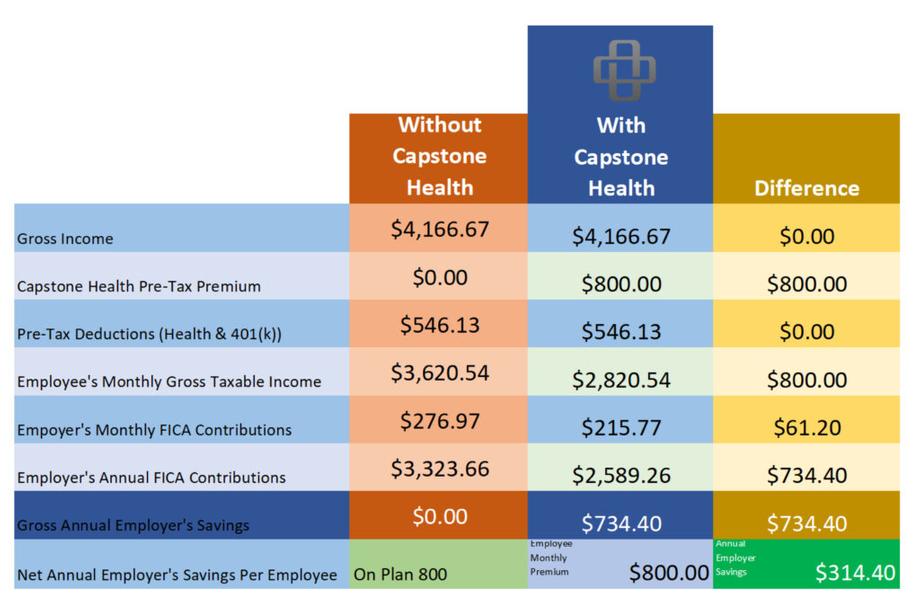

Discover how employers are benefiting from an annual tax savings upwards of $600 to $800 per employee with ZERO Net Cost while increasing their employees NET Take Home Pay.

Capstone Health is a new program that helps employers save money and improve employee health. We offer three main benefits:

• Tax savings of $400-500 per year per employee for employers.

• Tax efficiency of $120-150 per month per employee for employees.

• The ability to use employee savings to purchase qualified products under IRS Section 213(D).

This program is not a one-time deal, but a proactive health and wellness management program that can benefit both you and your employees. It was made widely available under the Affordable Care Act.

This program is not a one-time deal, but a proactive health and wellness management program that can benefit both you and your employees. It was made widely available under the Affordable Care Act.

Disclosure: The information contained in this graph is for general information purposes. J Diane Robinson assumes no responsibility for any errors or omissions in the content of this service.